Maker out of SoCal Va Belongings

An excellent Va financing Preapproval in purest function was a genuine conditional commitment to lend, granted from a great Va financing underwriter, helping a lender. Once you have achieved the Va financing preapproval, you might be actually happy to buy and you will intimate prompt, as long as the house or property matches the newest lender's criteria.

But not, not all the loan providers will underwrite an effective Virtual assistant mortgage file that have a beneficial possessions As Computed or TBD. That it a lot more extremely important step is a lot regarding work, and it will perhaps not generate a close loan while there is perhaps not property yet. It's been an unneeded most step. Yet not, for Virtual assistant consumers which have limited borrowing the excess energy is extremely demanded as credit reports had been analyzed from the underwriter.

Instead of an effective prequalification, a great preapproval is decided throughout the actual Virtual assistant mortgage underwriter's done post on the fresh new borrower's papers, besides relying upon all the info usually merely talked about towards the phone involving the borrower and financing manager. Less than, we shall talk about the strategies for finding a beneficial Va mortgage preapproval...just a beneficial Va loan Prequalification.

View it brief movies to own a quick need of the distinction anywhere between an effective Va Mortgage Pre-Acceptance compared to. a good Virtual assistant Loan Pre-Qualification:

Virtual assistant Financing Prequalification

Whenever an experienced gets pre-eligible to an excellent Va mortgage, these include provided with a quotation of financing size they would manage to achieve. This type of estimates are offered based on first advice brand new Seasoned will bring, commonly from an extremely temporary talk that have that loan officer. Which dialogue in addition to does not necessitate a credit score assessment. A very clear confirmation of your borrowing reputation and you can fico scores was always necessary, especially for Authorities loans for example a good Va mortgage.

Think about good Virtual assistant mortgage prequalification since earliest limited action which either may occur before actual Virtual assistant loan preapproval for the this new homebuying process. You can simply get a general feeling of your own to shop for energy next initiate in search of property. However, using even more measures are typically necessary to present a beneficial reference to an established bank who can then matter a powerful page appearing the certificates given that good Virtual assistant customer.

If you find yourself inquiring ways to get preapproved to possess a great Virtual assistant home mortgage, we'll supply the half loans in Iliff dozen short & basic steps here:

Pre-Approval vs Pre-Qualification: Very important Technology Variations!

While most industry players and you can consumers make use of the words pre-approval and you will pre-qualification interchangeably, there are extremely important differences to consider.

A great Va mortgage Prequalification generally is done by that loan administrator, and therefore craft might not include a credit check a massive ability with the recognition techniques. Obligations so you're able to money ratios can be determined with this passion, but count on cannot be used on a leading obligations ratio condition without needing the criteria out of Automatic Underwriting.

There's absolutely no option to this. A personnel from the financial have to obtain an effective tri-combine credit file while the ensuing credit ratings of each one of the three credit agencies. Unfortuitously, the fresh AUS or Automated Underwriting System shall be manage by the people personnel on lender, however the stability and you may legitimacy of your Automated Underwriting Study efficiency should be verified from the an effective Va Underwriter. The brand new AUS app most often put is known as Desktop computer Underwriter.

Enough errors can be produced in this processes by the novice players, however, men and women fatal problems was uncovered from the underwriter That's what They do! Of course, if this new error truly is deadly, the mortgage was refuted. When you find yourself when you look at the escrow buying, this isn't an enjoyable experience to determine you do not qualify!

A highly high most of the latest Va loan Preapproval email address details are delivered to borrowers from the mortgage officials using the AUS software by themselves, most rather than oversight. A new member with the tool can also be know how to services the software program in just a few times and be quite fluent within just months.

A word of Alerting...since the an unknowing Va borrower, you would not know if that it user have incorporated deadly mistakes. You can now type in the information on the app! Every borrows are not the same. You to definitely civil paystub is easy, and some was infamously challenging, exactly as are a couple of mind-operating tax statements. Ergo, errors for the money, financial obligation rations, continual income standards and could easily be an element of the preapproval.

This might be a vintage scrap inside, garbage out situation, where in actuality the result is just just like sensation of the software driver. If an unskilled loan officer produces a blunder and you will provides a good Va financing preapproval page for you, it may not getting reliable, top your down a sad roadway, went having troubles.

Pre-Acceptance versus. Pre-Certification Chart

The second graph have a tendency to break down the distinctions between pre-qualification and you may pre-recognition when you are responding some frequently asked questions concerning Va family mortgage processes:

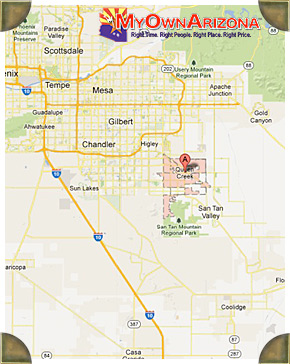

In the SoCal Va Residential property, we're purchased help you from Va mortgage prequalification processes as much as a TBD pre-approval, when necessary. We exceed to truly get you safely accredited and and come up with your own also offers attractive! I make techniques convenient and you can deliver greater results with the help of our book and strong programs.

Va Home loan Prequalification Calculator

You will find various calculators to simply help the preapproval to own a great Virtual assistant financial. All of our Virtual assistant mortgage calculator makes it possible to guess costs. And you can the other calculator may serve as an excellent Va mortgage prequalification calculator, because breaks down your finances and you will explains the debt percentages.

Ensure you get your Virtual assistant Financial Preapproval Now!

Sr. Virtual assistant Loan Gurus is right here to help you last, including Peter Van Brady which typed the main guide toward Va loans: To prevent Errors & Smashing Your Deals Using your Va Mortgage.