This is really mans response to closing costs. Yet not, you are not merely becoming nickel and you will dimed. In this post, we'll mention:

- What you are actually investing in once you shell out closing costs

- Exactly how much mediocre settlement costs can be found in Utah

- The best way to to evolve the loan's terms having lower closing costs

- Tips and tricks that will probably lower your settlement costs

Too frequently, asking to get your closing costs ahead of time out of your bank is like move teeth. Not on Area Creek Home loan. The goal is actually openness and you will transparency, so we conveniently promote closure pricing estimates if you use our very own rate finder and you will closing cost quote product. It requires lower than dos times. While some of them quantity is subject to changes just before closing, i founded that it product to get as the clear, comprehensive so that as specific that one can.

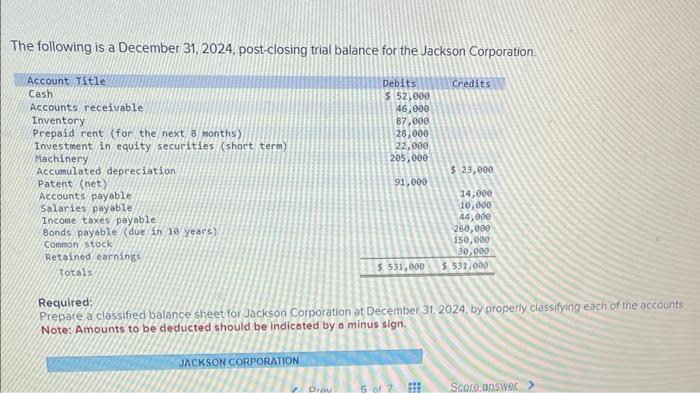

To locate a quotation such as the one you find throughout the picture over, simply have fun with all of our rates and you will closure cost calculator unit because of the wanting an option less than.

What's With it For me personally? As to the reasons Also Purchasing Closing costs?

The common home visitors will not understand why these are typically paying closing costs, they just learn they must attain its brand new home.

Closing costs coverage many important attributes and you may charges you to definitely assists a safe, legally compliant, and successful home buy process.

Expenses closing costs ensures that the house was truthfully respected, the new identity is clear of every liens or encumbrances, together with exchange was securely recorded and recorded on compatible authorities.

As opposed to these types of services, the purchase out of a property is full of uncertainty, legal risks, and you will possibly devastating economic loss for people and providers. Really, settlement costs provide safeguards to you since a house client or vendor by defending your next otherwise newest funding, and making sure this new easy import off possessions ownership.

What to expect: Just what are Closing costs inside Utah?

With respect to the latest federal investigation , in installment loans online Edmonton Kentucky the 2021 the average settlement costs inside Utah are $4,837 which have the common household purchase price out of $488,644. This is certainly around step 1% of one's cost out-of a house. Utah's settlement costs is actually below new national mediocre.

Brand new national mediocre for closing costs is $6,905, which has domestic import fees. But not, Utah is one of a minority away from claims which do not has import taxes whenever completing house transactions, very Utah's figure does not include taxation. Instead of transfer fees, the newest federal mediocre to possess closing costs for the 2021 is $step three,860.

In short, What Also Are Settlement costs?

Settlement costs is costs one to consumers and sellers need to pay in order to complete a house purchase. Both homebuyers and sellers shell out specific closing costs, and these costs tend to be charges energized of the third parties plus the lender.

Across the nation, homeowners is also anticipate paying from 2% in order to 5% of one's purchase price of the land in closing can cost you. Because of this possible buyers is to prepare because of the putting aside currency in their eyes in addition to their down costs.

According to the Zillow Home values Index , the typical really worth otherwise price of an individual-house inside the Utah since 2023 try $495,920, and property in some counties of one's state has actually higher average rates. When you're searching for property, this means that you can anticipate paying somewhere within $9,900 to help you $24,790 in conclusion can cost you if you buy property within an excellent cost equalling the common family worthy of on condition.

Thankfully, however, you can discuss the responsibility for investing settlement costs into merchant, and you will closing costs include below the latest federal average set of dos% in order to 5% to own people within the Utah.