Happy to buy a new family although not yes just how to go about taking a home loan? During the Solarity Credit Partnership, we realize it is essential to have as frequently suggestions to before you make major economic decisions. Very, if you've ever experienced lost trying to puzzle out lenders, you are in chance. Since advantages, the audience is ready to assist. Here's how you can be eligible for mortgage brokers in Washington County.

Exactly what are the standard criteria so you're able to qualify for home loans within the Arizona State?

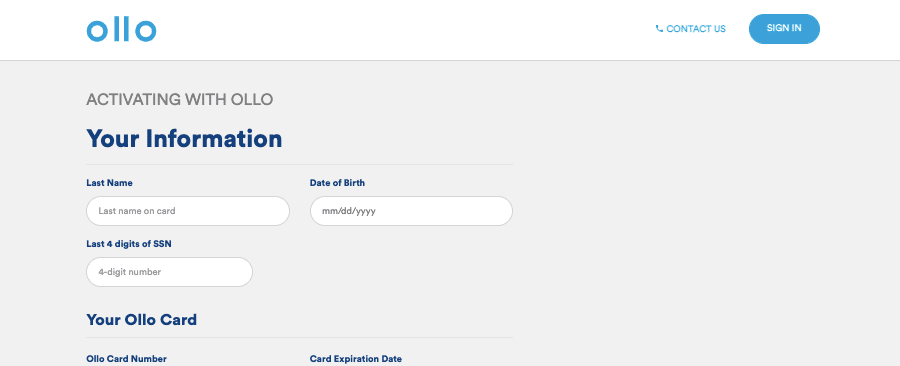

Before applying to own Arizona State mortgage brokers, you ought to collect the required guidance and you will data files. After you have this ready, you could sign up for a mortgage and you can fill in the data to help you a lender. The financial institution will likely then be certain that exactly what you given and you can, if required, request additional information/files.

Character. You'll need to be capable prove your label, so have those types of records able. These may is your license, passport, Social Security count and other formal kinds of images ID.

Construction records. Their leasing otherwise homeownership history is additionally requisite. You will need your current address additionally the address contact information off elsewhere you lived in during the last couple of years.

The manner in which you want to make use of the purchased assets. You will additionally need to let a potential bank understand what particular possessions you need to use the mortgage getting. That means specifying if or not this is supposed to be most of your residence, a holiday family, accommodations or something other.

Additionally must promote specific private economic guidance, together with evidence of money, lender statements, the previous years' taxation statements, established financing details and a lot more. A loan provider allows you to know exactly what is called for and might also provide a checklist. Let us look closer at the this type of requirements.

Financial recommendations

While looking to get an arizona Condition financial, you may need two months out-of newest financial statements in a position. Anticipate to divulge expenses and assets as well and when you've actually ever submitted getting personal bankruptcy. Property were later years membership, IRAs, checking/savings accounts, brings, securities and you can similar levels.

If you make monthly loans repayments, record the new stability, payment quantity therefore the names of your own lenders. While this advice would-be available in your credit report, its great for your own lender to possess that it in advance inside the purchase to talk you through the numbers of what you may have the ability to afford.

Proof money

You will need evidence of income for the past 1 month. Usually, this means the two current spend stubs. It is very important inform you the lending company which you continuously has money to arrive and certainly will consistently, letting you create month-to-month costs for the the borrowed funds.

Additionally, you will must reveal proof of money for the past a couple of years. Work and you may income records shall be found by giving during the last 2 years off W-2s. Whenever you are care about-employed, supply the earlier in the day a couple of years of tax statements together with associated schedules. Proof earnings loans Temple Terrace FL comes with overtime, fee and you will money from next operate otherwise top hustles.

But a job is not the only proof of earnings to add. Allow your financial determine if you get some of these:

Debt-to-earnings proportion (called DTI)

Your own evidence of money and you can listing of expenses will assist the newest lender determine the debt-to-money ratio (DTI). Which is, new part of the debt compared to your revenue. DTI is another answer to assist a lender see you might dependably generate monthly premiums. Additionally provides them with an idea of just what part of your own money would go to certain fees and this what is going to be accessible commit into loan costs.

How will you determine your DTI ratio? Make sense your regular, repaired month-to-month expenses, separate one to by your pre-tax money and you will multiply the quantity from the 100.

Lower DTI quantity are more effective. All the financial features various other requirements, but also for extremely, so you're able to be eligible for an arizona County mortgage, your DTI proportion are going to be forty-five% or reduced.

Credit score

Included in the processes, their bank will run your credit rating. Fico scores are indicative regarding financial position and creditworthiness. A higher rating demonstrates to you is actually a reliable debtor who is in charge having money and they are expected to shell out it back. A low get is also demonstrate financial inconsistency and you may habits away from overspending and not easily to make repayments punctually.

Basically, you'll have a credit score out-of 630 or maybe more. However, if a is a little down, you may still be eligible for a home loan. View authorities-recognized finance and you may communicate with lenders to understand more about your options.

You'll be able to change your credit rating. Otherwise you want a mortgage instantaneously, taking the time to improve your own rating before you apply to own financing can make a distinction.

So what can I actually do adjust my credit history or straight down my DTI proportion?

There are certain actions you can take to change your credit while increasing your credit rating. They are:

These types of strategies, particularly settling bills, will be lessen their DTI, also. To boost that ratio, you can you will need to raise your earnings. This could mean asking for an increase, doing work overtime otherwise carrying out an additional employment.

Exactly how getting pre-approval having home loans into the Arizona Condition helps make something much easier

Prior to trying to qualify for home financing, introduce all the info above to locate pre-recognition from the bank. This will help you in 2 suggests. Very first, it can make you a concept of exactly how much family you can afford with your latest cash. This will allow you to search for homes in your price range. Being pre-approved and reveals manufacturers and you will real estate professionals you are a serious and you will licensed visitors., Apre-acceptance could be the difference in your render providing accepted on the a house or otherwise not.

Solarity Credit Union's Financial Guides to own Washington Condition

In the Solarity, we feel in making homeownership much more available for much more anybody. This may involve all of our efforts to really make the whole process more straightforward to learn. Solarity's Mortgage Courses try here to you every step out of the way in which. When you talk to our Books, they are going to go over your finances and you will requires, which will leave you a much better notion of the techniques performs, exacltly what the monthly obligations was and more. Get in touch with all of us today, and we'll connect your on the finest pro.

Discover additional information throughout the Solarity plus the sorts of home loans into the Arizona County i've readily available by the investigating our website. After you've accompanied this new tips in depth significantly more than, you'll implement on line getting pre-recognition to have a mortgage while having already been on your own homebuying travel.

Our specialist Financial Courses try right here to help

Nothing is the house Loan Instructions love more than watching people transfer to its dream house. The audience is right here to keep one thing as easy as possible (including a totally on the web but really custom techniques)!