- Take note of the eligibility requirements and you may affordability prior to getting good second assets.

- The fresh previous increase in A lot more Buyer's Stamp Responsibility (ABSD) mode might you desire a lot more dollars when selecting a second house.

- Purchasing an additional property boasts a great deal more economic responsibility; it is told to-be clear regarding your mission for buying the next possessions

Having rising prices controling statements when you look at the current days, interest rates are ready to rise subsequent from the upcoming days. When you yourself have become planning to to get an extra property, this is often a good time first off appearing as the an effective increase in rate of interest might just indicate stabilisation from assets pricing.

Apart from the price of the property, there are some something might must be aware of when to purchase an additional family, such as for instance qualification, cost and you can purpose.

Eligibility

For many who own an exclusive property, then you will be liberated to purchase a moment personal assets without the court implications. not, if the very first property is a public casing, be it a create-to-Buy (BTO) flat, selling HDB flat, government condominium (EC), or Construction, Make market Strategy (DBSS) flats, then you'll definitely need complete specific criteria before you buy.

HDB flats include good 5-year Lowest Occupation Period (MOP) specifications, meaning that you'd need inhabit you to definitely assets to own a good minimum of 5 years before you promote or rent out the apartment. You'll also need to fulfil the newest MOP through to the purchase of a personal possessions.

Do remember that just Singapore customers should be able to very own both an HDB and you will a private possessions at the same time. Singapore Long lasting Residents (PRs) should escape of their flat within this half a year of your own personal possessions get.

Value

Land are known to feel infamously costly into the Singapore and careful calculations need to be made to make sure that your second property get remains affordable to you. Might need to take note of your own after the:

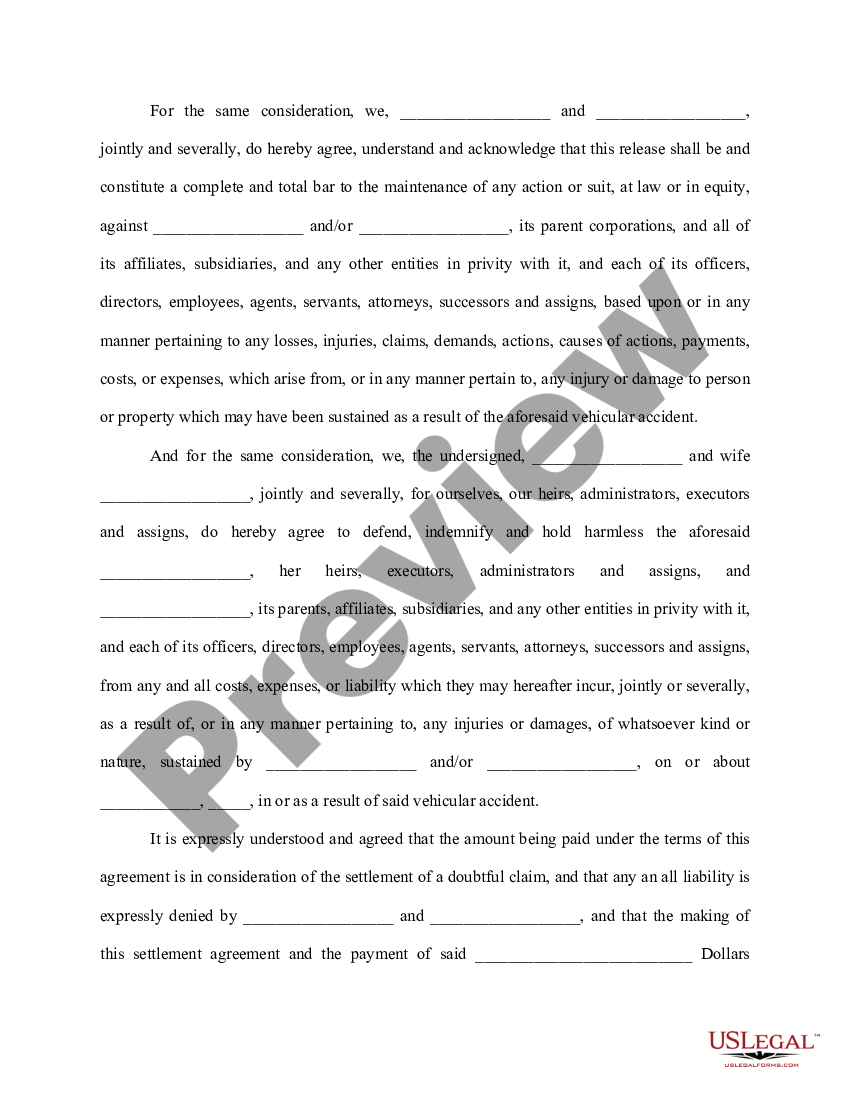

Might need to pay ABSD once you pick another residential assets. Extent might have to pay relies on your character.

This new ABSD is past adjusted to the within procedures so you're able to promote a renewable property industry. Newest pricing was reflected about table less than:

Given the latest ABSD prices, good Singapore Citizen which currently owns a keen HDB flat but wants to purchase a private condo costing $one million has to fork out an enthusiastic ABSD off $200,000 (20%). Perform keep in mind that that it number is found on the top of customer's stamp duty.

Very first domestic purchase demands just around 5% dollars deposit for folks who used a financial loan, your second property needs a twenty-five% dollars downpayment of the property's valuation maximum. Considering a house that is appreciated on $one million, might you want $250,000 dollars for down-payment.

The Debt Servicing Proportion (TDSR) design are delivered on to avoid home buyers of borrowing from the bank as well far to finance the purchase regarding a property. Underneath the build, home buyers are only able to borrow to up 55% (modified to the ) of their terrible month-to-month earnings.

When you have home financing linked with very first assets buy, it can significantly affect the amount you could potentially obtain for the 2nd home. Yet not, if you have currently cleared the loan in your very first family, then you'll definitely just need to ensure that your month-to-month homes loan repayments and additionally other monthly bills do not exceed 55% of your month-to-month income.

For your basic construction loan, you are entitled to borrow to 75% of the property well worth when you are using up a bank loan or 55% should your loan tenure is more than 3 decades otherwise stretches early in the day decades 65. For the 2nd housing financing, the loan-to-well worth (LTV) proportion drops to forty-five% to possess loan tenures as much as thirty years. If the mortgage tenure surpasses 25 years otherwise the 65th birthday, their LTV falls to 31%.

As you care able to see, to get one minute assets if you are nevertheless investing in the borrowed funds of the first domestic will want even more bucks. According to a property valuation off $1 million, you'll likely you would like:

While it is it is possible to to use their Main Provident Finance (CPF) purchasing another possessions, for those who have currently utilized the CPF to you basic household, you can use only the additional CPF Ordinary Account coupons to have your second property here are the findings once setting aside the present day First Old age System (BRS) away from $96,000.

Intent

To purchase the next property comes with so much more economic responsibility than the your first one to, and is told become obvious regarding the objective to have buying the 2nd assets. Can it be to own funding, or could you be utilizing it because the a moment home?

Making clear the purpose will allow you to for making particular choices, like the brand of property, together with going for a place who does finest fit the mission. This is certainly particularly important if the second property is a financial investment assets.

Like most other investment, might need to workout the potential rental give and you will resource fancy, and dictate the fresh new estimated return on the investment. Because the property buy is a huge resource, it's also wise to enjoys a technique you to imagine facts eg:

What is disregard the horizon? Are you willing to aim to sell for a profit shortly after 5 years, or perhaps to retain it toward a lot of time-name to gather lease?

Whenever and exactly how would you cut losses, or no? If the home loan repayments are greater than the lower rental income, how long would you wait before promoting it off?

To purchase a house in the Singapore was financing-intense and buying an extra domestic will require a great deal more financial prudence. One miscalculation might have high economic effects. Therefore, establish a clear bundle and you can demand a wealth thought movie director to with you can easily blind places.

Start Planning Today

Below are a few DBS MyHome to work through new figures and find a home that suits your allowance and you will choice. The best part it incisions out the guesswork.

As an alternative, prepare yourself with a call at-Concept Acceptance (IPA), you have certainty on how much you could use to have your residence, allowing you to see your budget precisely.