Really does the notion of living in the world or suburbs interest to you personally? Think about to acquire a property without currency down? That have a great USDA Outlying Innovation loan, you can do one another!

USDA (RD) mortgage loans are authorities backed financing. The borrowed funds are funded or originated from the a lender (particularly MiMutual Financial) however, features a promise in the United states Agencies of Farming Rural Innovation (USDA RD). Thanks to this guarantee, there can be less exposure towards the lender, hence enabling even more advantageous mortgage terms and conditions towards borrower.

Zero Advance payment:

Perhaps the top benefit of a good USDA RD mortgage is the down-payment requirement. Nowadays, a lot of people find it hard to set aside a lot out of savings. Quite often, rescuing right up to own a down-payment was cited as one of the greatest traps so you can homeownership.

Flexible Credit Requirements:

USDA RD financing have significantly more easy borrowing from the bank standards and you will personal bankruptcy guidelines in comparison with antique fund. Just like the USDA itself cannot put the very least credit rating, lenders put her minimums. Of many loan providers require a rating with a minimum of 640. MiMutual Home loan, although not, allows fico scores as little as 580, rendering it mortgage system a choice for individuals that have less-than-primary borrowing from the bank histories. Which autonomy reveals options for those who possess came across monetary pressures in the past.

Keep costs down

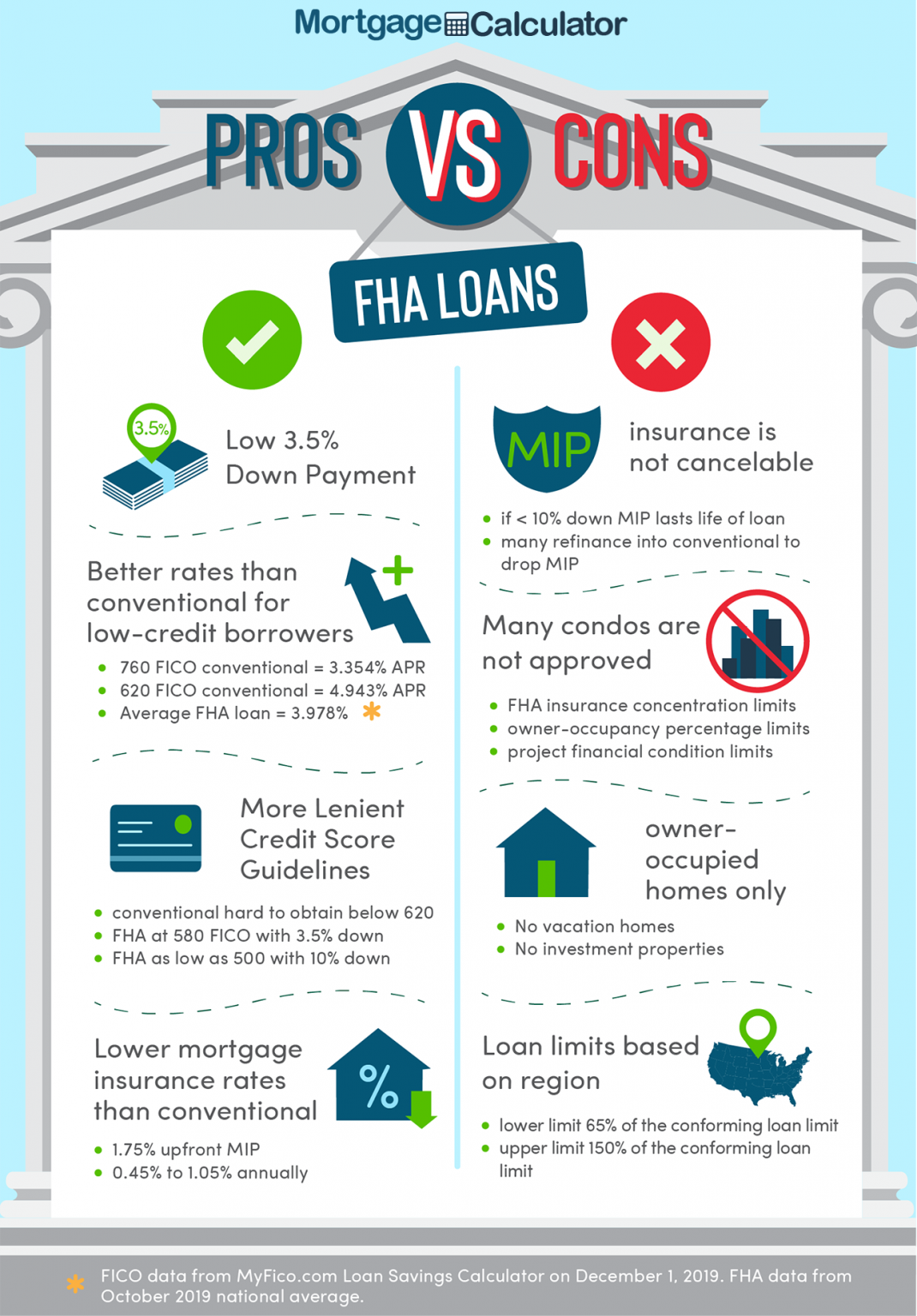

USDA RD loans give you the cheapest home loan insurance fees when as compared to almost every other loan programs. Both the initial financial cost (MIP) plus the annual mortgage insurance is more affordable than what try required for FHA fund. The latest RD MIP as well as always are cheaper than traditional Personal Financial Insurance policies (PMI).

While doing so, not all of your own settlement costs need to leave wallet. The closing costs can be secured compliment of merchant concessions (as much as six% of one's price) or courtesy gives, current money, otherwise condition Deposit Recommendations (DPA) programs.

Just to buy:

MiMutual Mortgage offers USDA RD finance both for to acquire or refinancing property. If you purchase or refi, qualified consumers meet the requirements to possess 100% resource. New RD Improve system enables you to re-finance your current RD loan with ease! While the label ways, the procedure is a quicker, sleek procedure that waives the latest termite, well, and septic checks. With no this new assessment will become necessary!

Support having Outlying and you can Suburban Section:

USDA RD loans are specially designed to service outlying and residential district communities. So it means that some one staying in this type of section gain access to sensible investment alternatives if you're generating monetary invention and you can balance.

Therefore, now that we've chatted about some great benefits of new RD loan, lets look closer within some of the qualifications requirements:

You'll find income recommendations

You don't need to become an initial-time family consumer, you must meet certain earnings assistance. RD fund identify one to a debtor cannot meet or exceed 115% of their local median house earnings. Observe the modern money eligibility restrictions, check out the USDA RD webpages on:

The house need to be based in an outlying town

You will be questioning, what's considered rural? There are a variety regarding significance with what comprises an effective rural city against an urban otherwise town area and therefore is lead to confusion on a property's system qualifications Saraland loans. Some people contemplate remote, dusty state roads after they thought outlying, you may be surprised at how many features are located in an effective USDA outlined rural' town. Society, geographical separation, and also the local labor market are typical facts believed.

The way to determine if your house is for the good USDA appointed outlying town should be to look at the program's qualification chart during the: Click!

Financing conditions, constraints, and eligible property versions

Instead of a normal or FHA mortgage, USDA will not lay a maximum financial matter for RD funds. No limit conversion rates, this might opened your options. But not, RD financing are just available because a 30-12 months repaired financial, and you will again, should be located in an area defined as rural.

Qualified possessions types include solitary members of the family home, PUDs, this new structure (recognized as below one year dated having Certification away from Occupancy),short conversion and you can foreclosed property, webpages condos and you will present are designed home eligible for the new Are built House Airplane pilot Program (certain county eligibility limitations implement).

Characteristics maybe not qualified to receive RD funding become those who was income-producing, significantly less than structure, situated in an urban area and you may/or otherwise not deemed given that very good, as well as sanitary (DSS) of the USDA standards. DSS standards in a nutshell, ensure the home is structurally secure and safe, and everything in a great operating buy. If the a property is not meeting DSS requirements, it should be listed in a good repair prior to resource or on mortgage financing.

As you can see, USDA RD finance are a good solution if you are searching to reside off the defeated roadway and need 100% capital having No down. So, if you're Up and running Rural, our company is prepared to help produce here!