Additionally, you will you want deals to own closing costs, being typically dos-5% of the amount borrowed. You have to pay settlement costs at the time you're taking ownership out of the house. In some cases you could discuss to split such can cost you having the seller or feel the vendor outlay cash in exchange for almost every other allowances.

With currency to pay for settlement costs and deposit into the an account the spot where the financial institutions are able to see all of them is essential to possess an aggressive mortgage pre-recognition. For this reason youre generally speaking necessary to complete bank statements for the application process.

3. Build and you may Repair Borrowing from the bank

If not obtain the pre-recognition you prefer, bringing two months to alter the credit may help. Listed below are some activities to do:

- Make into-big date repayments.

- Build greater than lowest repayments to pay off financial obligation smaller.

- Chat to credit reporting agencies to eliminate dated or inaccurate things for the your declaration.

- Consolidate small-debts towards more substantial loan. Also pay attention to the interest rate to make certain you you should never spend so much more fundamentally.

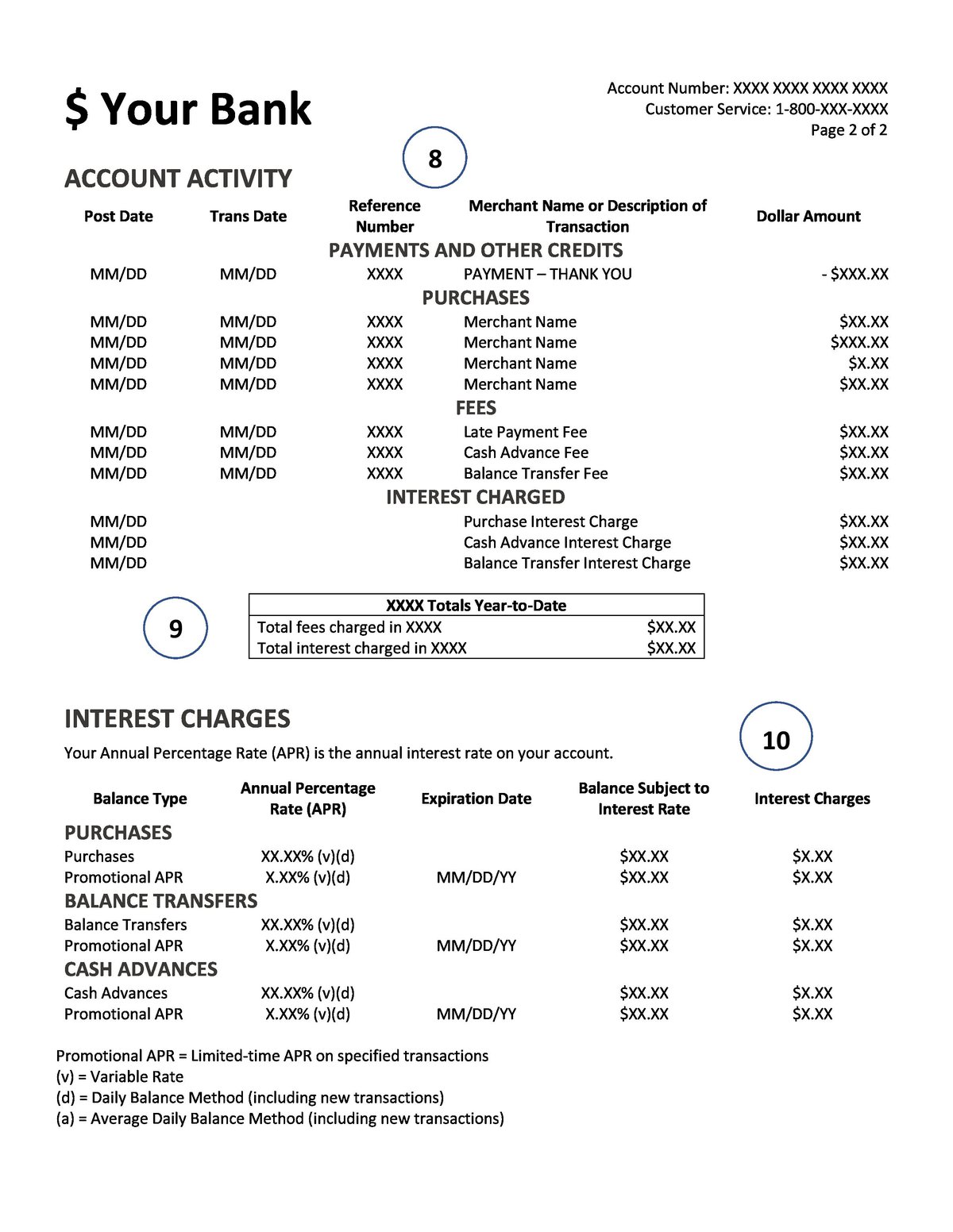

- Unless you enjoys a track record of borrowing from the bank, discover a charge card and you can pay it back monthly to help you make suggestions makes new costs.

Together with all these info, you can consult with an IMCU loan administrator to find more and custom recommendations for improving your credit score.

Lastly, you can look at placing anyone else to the financial to improve extent you have made recognized for. You can learn someone who was willing to co-sign, meaning it agree to protection the fresh money for people who default toward the borrowed funds. Yet not, a good co-signer is not constantly entitled to the property otherwise fund in the question.

To be a part-owner, anyone should be an effective co-applicant into the home loan. A co-candidate experiences the financing recognition techniques and has its money mentioned included in choosing the mortgage number. They will also be entitled into the label of the property and you will express within the legal ownership. Bringing a cosigner or co-applicant can increase the amount of a mortgage.

The way you use an effective Pre-Acceptance Financial Calculator

A pre-acceptance financial calculator allows you to to improve extent you use, the size of the loan title loan New Jersey, and also the rate of interest to see exactly how your monthly obligations transform. Remember, even though you are pre-recognized to have a specific amount does not always mean you have got to purchase this much into the a home. Playing with a calculator allows you to see what your monthly premiums usually become. Following, can help you the latest mathematics to ensure that you often nevertheless has actually a soft finances.

After you get the commission that you're at ease with, you can easily go shopping for homes because price range and put your self upwards for achievement. New IMCU mortgage calculator actually lets you cause of an excellent pre-payment to see if expenses much more towards your home loan within duration of closing, yearly, otherwise per month, allows you to save money ultimately.

Score Pre-Approved With Indiana Professionals Borrowing Partnership

The brand new Indiana Members Borrowing Relationship group off financing officials has experience in the approaching every loan systems. All of our service-basic way of financing to the words which can be right for all of our users enjoys helped all of us grow matchmaking with many real estate professionals. He is just some of the people exactly who believe me to help funds land. Just like the a card partnership, our company is a no more-for-profit standard bank that really aspires so you can real time the brand new way forward for your ambitions on your own next home. I receive one to use today having a mortgage pre-acceptance. Get in touch with you on line, through email address, over the telephone, or perhaps in people, and we will put the heads together in order to policy for what is second.

How much time Does Pre-Recognition History?

Having deals will not merely help you get a mortgage, it can also help you end particular charges and you will get ready for someone else. If one makes a down-payment out-of 20%, you might avoid the price of mortgage insurance rates, that'll help you save up to 1% annually. Which could not sound like a lot, but along the period of a beneficial 20-31 12 months mortgage, it can seem sensible!