Home guarantee loans and you will home security credit lines (HELOCs) all are ways residents utilize brand new equity they have in their belongings. Even though these types of financing is actually affordable and you will much easier, they are certainly not suitable for anyone and every situation.

Listed below are around three well-known ways in which these money are usedparing the pros and you may disadvantages can help you create a sensible borrowing from the bank choice.

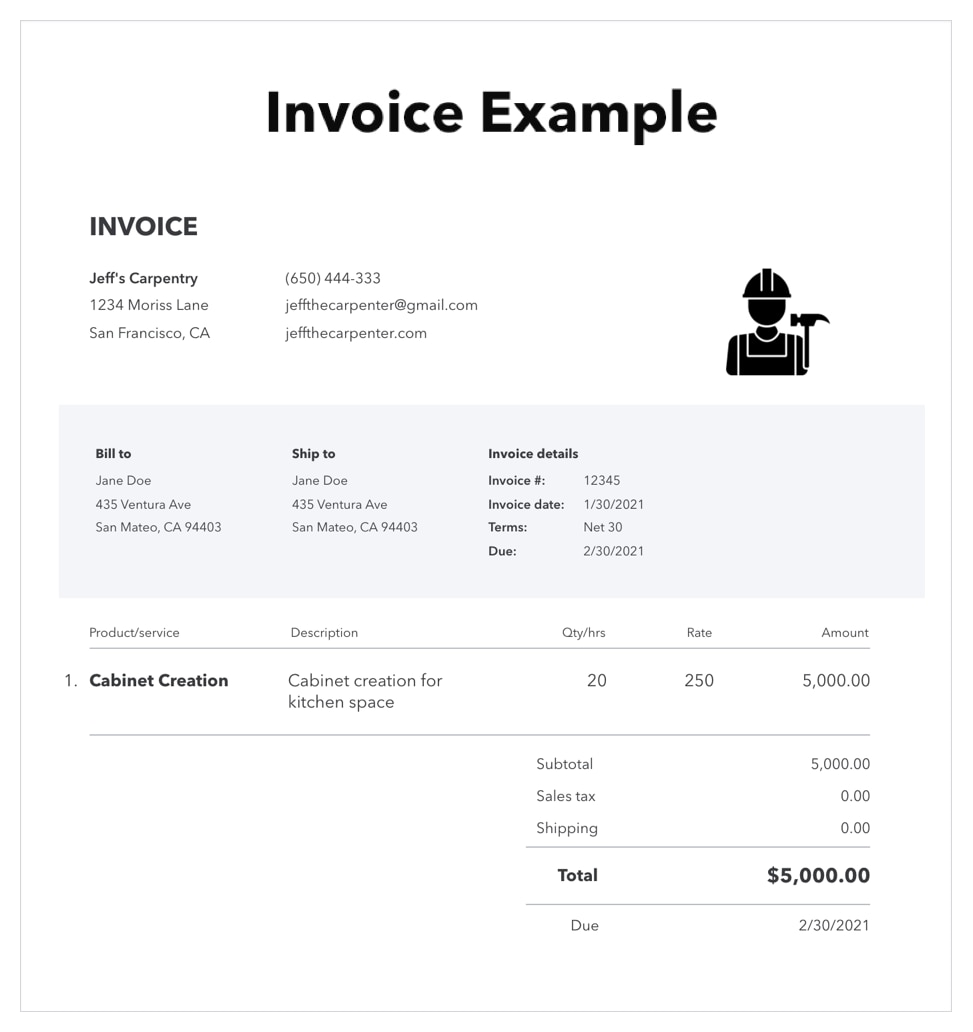

Household Renovations

Perhaps one of the most common spends of house guarantee financing and you can HELOCs is actually for doing household recovery tactics. Whether you're building work your residence or strengthening an addition, these types of loans allow you to use the equity of your house while making your property better yet.

The benefit of having fun with property equity mortgage getting an effective household repair project is you can lock in the attention speed in the event the mortgage is established. This is exactly an essential attention whenever costs was ascending. Then you're able to pay back the loan that have repaired monthly premiums and you can not have to value any unexpected situations afterwards.

When taking away a house collateral loan, might receive a lump sum on the full number of the mortgage. It isn't really standard if you expect you'll complete the opportunity inside level and you also just need to spend small amounts simultaneously. Repayments on your financing begins just after obtain this new lent money.

A significant benefit of having fun with good HELOC having property recovery project is that you could just borrow the cash you desire when it's needed. Including, you can borrow some money to purchase wood to have an area introduction and you can, following the shaping is fully gone, you might borrow a few more to find drywall, floors, and you can painting.

HELOCs has adjustable interest rates. This might result in your purchasing a whole lot more for cash you obtain in the event that prices improve. Not knowing exactly what upcoming rates could be including renders budgeting difficult.

Consolidating Loans

For those who have multiple high-attract bills-such as for instance playing cards and you can shop cards-checking up on the fresh payments will likely be difficult in the event the money is rigid. Miss you to definitely, and it can harm your credit score. The fresh new large-interest levels could also have you end up being trapped into the an excellent course off financial obligation.

Family Equity Financing Expert

Home equity loans usually have down rates than other borrowing alternatives which might be used in debt consolidation reduction. Allowing it can save you money, also it can along with make it easier to pay back your debts quicker.

Household Equity Financing Swindle

With regards to the bank, a house security mortgage may have costs. You may need to pay for the application, origination, home appraisal, and you can closing. These types of costs you can expect to outweigh the advantages of merging the money you owe. If the costs was high, another investment alternative are a much better alternatives.

HELOC Specialist

There are a couple important HELOCs pros and cons in order to envision. Having a beneficial HELOC, you may make interest-simply costs towards currency you use until the money you owe advances. It is possible to make focus-only money provided new draw months is actually effective.

HELOC Scam

Just as postponing this new installment of your principal that have attention-only costs is going to be a plus whenever cash is rigid, it's also a drawback. For folks who keep putting off settling the cash you owe, the bill will ultimately been due.

HELOC mark periods don't last permanently. When your comes to an end, good balloon commission ount, that'll result in financial distress without having the currency. Dependent on your own lender, it could be possible so you're able to refinance the bill to your a separate mortgage and you will pay it back that have repaired monthly payments.

Major Costs

Many people make use of the guarantee within their property to cover purchase of things needed or wanted. Just a few for example:

- Furniture

- Scientific expense

- Automobile fixes

- The appliances

- Family electronic devices

- To fund a wedding

Family Security Mortgage Professional

Domestic equity funds allows you to borrow the cash you need with an interest price that's much lower than credit cards or store notes. The fresh new offers might be extreme.

Domestic Equity Mortgage Scam

Depending on your lender, it might take 2 to 4 months discover a property equity financing immediately following implementing. It might not feel recommended if you prefer currency prompt.

Family guarantee financing charge and you will closing costs also can make this credit choice higher priced than many other fund. If you need to repair otherwise replace the signal on your own vehicles, particularly, a personal loan could be quicker that have a lot fewer (if any) charges, while you will pay increased rate of interest.

HELOC Expert

We sign up for HELOCs to make use of because the emergency copies inside circumstances one thing goes. You'll encounter a credit line that you could draw out-of to pay for unanticipated scientific costs, fix a leaky roof, or have your vehicle's ac unit repaired East Pleasant View loans. The cash could there be to you as it's needed.

HELOC Swindle

Because collateral of your house can be used just like the guarantee, you might be necessary to pay off people a great balance for folks who promote your residence. When you can use the money you receive regarding the product sales in your home to repay your own HELOC, it does log off less overall on exactly how to purchase a different household.

Tap into Your home Equity with Atlantic Financial Borrowing Partnership

Family collateral money and you will HELOCs are perfect for placing the fresh new security you have of your home to utilize. Whether or not a home security financing or HELOC is useful for the borrowing from the bank requires depends on the fresh meant play with. Definitely consider the benefits and drawbacks meticulously before carefully deciding.

If you are considering sometimes property collateral mortgage or HELOC, Atlantic Financial Government Borrowing from the bank Commitment even offers both loans which have aggressive focus prices and simple capital conditions. Click on the connect lower than for more information on the house collateral borrowing from the bank options.