- Large financial company costs: If you use a large financial company so you can discover and you can safe a home loan, they may ask you for due to their properties.

- Insurance: If you have a home loan, you will usually have to have building insurance policies to pay for wreck into possessions. It's also possible to you need other kinds of insurance, particularly public liability insurance.

Securing a professional home loan takes longer than protecting a residential home loan. Such mortgage loans often involve cutting-edge assets versions which need detailed critiques. This will boost the date it will require to obtain the fund need.

Faster freedom

A professional financial try a lengthy-label connection that usually persists anywhere between step three and you can 25 years. As a result if you want to flow your organization having any reason, it could be much harder for many who own your property. You would have to offer your house before you can flow, which can take some time or end up in a loss of payouts.

Trying out home financing includes certain dangers. Property values can go off along with up. If your value of minimizes through the years, disregard the might end upwards being worthy of below what you paid for it.

There are even threats if you cannot maintain their mortgage repayments. Should your company faces financial difficulties that prevent you from investing their mortgage, you can chance losing the property. Inside a bad-situation situation, this could resulted in incapacity of your providers.

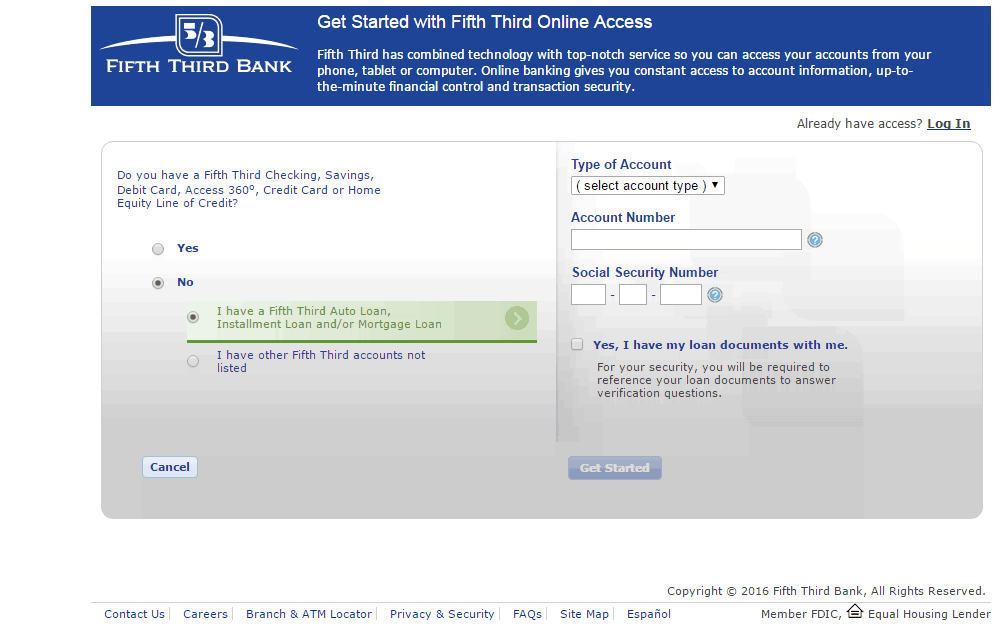

You might estimate your interest rate with a commercial home loan calculator. You are going to complete the house or property really worth, amount borrowed, and loan title. You will then discovered a keen illustrative payment considering most recent home loan costs.

The pace obtain for the mortgage is dependent on some affairs. We high light the standards one to feeling a professional financial to own proprietor-occupiers below:

Credit rating

Your credit rating and the credit score of the organization try key factors. A healthier score can display lenders that you're a reduced amount of a danger, which could mean youre entitled to down rates of interest than if you had a poor credit get.

A large financial company might be able to help you get a beneficial commercial mortgage having less than perfect credit, cash advance out of Mcdonald Chapel Alabama since there are lenders who will be created to help with certain facts.

Commercial lending sense

Commercial credit experience make a difference your ability so you're able to obtain. Lenders see previous profitable money since proof of economic reliability and the capacity to would a commercial property and financial.

Owner-filled industrial mortgages for brand new companies are given by fewer loan providers, but may be available. A professional broker can help you assess the options.

Organization success

Loan providers can look at the business's finances. For example your earnings, cash flow, and personal debt profile. In case your providers funds is compliment, you can be eligible for interest levels that have a wide selection of lenders, and you will possibly all the way down cost.

Property

A the house or property will be utilized for influences the borrowed funds to worthy of you can safe. Either scientific means can also be secure doing 100% loan to help you well worth, while other markets have a much all the way down cap.

Also, which have a partial-industrial property spanning each other business and you can home-based rental points, the borrowed funds to help you well worth could well be impacted by the proportion of per ability.

More home-based the better (however, the audience is especially talking about a domestic ability that end up being leased so you can a tenant, due to the fact worry about-job are capped at the forty% of your own area).

Initial rate several months

According to county of mortgage business, the length of the original price ages of a professional mortgage may dictate the pace.