Merging existence mode merging economic products, even although you keep bank accounts separate. Each person brings into the dating their own credit history, and this you will are college loans or other financial obligation.

Prior to your wedding day, it's a good idea to examine your finances with her so there will not be any shocks. This will also assist you in deciding simple tips to plan for upcoming costs, including paying debt.

How do student education loans perception relationships?

According to Forbes, education loan obligations is the next-large consumer debt group in the usa. More than 49 billion Us citizens enjoys education loan obligations. You are able that you will be marrying somebody which have student loan personal debt, or if you might have student loan financial obligation yourself.

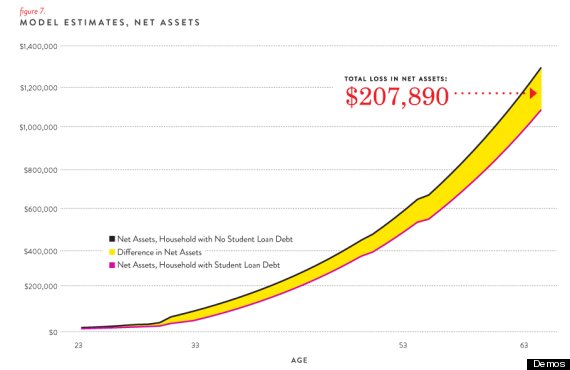

Even if the obligations is just in one man or woman's title, it will nonetheless apply to each other partners. That is because currency has to be assigned each month to help you purchasing regarding one personal debt, in addition to process may take date, based on how much you borrowed from together with amount of the latest mortgage term. Spending that cash straight back impacts your money disperse and you may coupons.

For folks who accumulate education loan personal debt throughout marriage, that and connect with one another partners, particularly in a residential district possessions condition. That is right even when the mortgage is in one person's identity.

Really does marriage apply to your credit score?

The way wedding affects credit ratings try difficult. When you're your credit rating really should not be in person impacted by your spouse's student loans, in case the financing were pulled before getting partnered the spouse's borrowing score will influence the interest rate a lender has the benefit of when you're applying for more financing along with her.

That means if you apply for a mortgage or auto loan together with her, the financial institution can look from the one another credit ratings when determining this new price. Which have student loan financial obligation does not mean the credit get might possibly be all the way down, nonetheless it can be harm your ability to track down additional loans while the the financial institution talks about the debt-to-earnings ratio to choose their creditworthiness. In the event that those individuals figuratively speaking aren't are paid down promptly, it can affect the spouse's credit score, which can impact a joint loan application.

If you don't take on joint loans or discover a joint membership (a credit card or mortgage along with her, particularly), your own borrowing really should not be mingled. Yet not, which have a combined account, each person is actually as you guilty of spending men and women expense. This means in the event the companion does not pay the bank card bill, eg, you are guilty of the entire situation, even if it were not costs your physically accumulated. A late payment will teach on the credit history, whether or not your wife pays the fresh new expense. People borrowing ding with the those individuals mutual profile attacks all of your credit ratings.

Would you have more taxation being married?

ount of cash taxation you only pay. When you have lower income as well as your lover produces a higher earnings, you may want to get into a higher income tax bracket having a recently combined figure by the processing jointly; that is, your family is addressed as the a equipment.

After you spend alot more inside fees, once engaged and getting married, people name you to definitely a marriage punishment. You will be able, no matter if, to spend quicker when you look at the income taxes whenever hitched, which can be titled a married relationship added bonus.

You'll want to speak with a taxation specialist about delivering married often affect your own tax pricing so you can bundle ahead of https://elitecashadvance.com/loans/easy-payday-loan/ time and you can find out about the fresh new possible financial transform that can effects.

Prior to getting hitched, additionally it is a good idea to talk to an economic professional about the implications from taking up obligations for starters partner when hitched and the you can aftereffects of one to otherwise both spouses with personal debt ahead of wedding. Which have a strategy in place to deal with the debt, you have a smoother marital change.