This type of pros provides strong information about from basic mortgage loans to help you refinancing and certainly will meets you on right economic equipment to be right for you to your better financial income.

Possessions particular has actually a giant part in the manner far you can use to own a home loan. Lenders commonly put lowest possessions values, usually doing ?forty,000. It means when you need to pick a small house otherwise an apartment, the choices for quick mortgage loans may look more.

The kind of Warrior AL payday loans household you select influences just the borrowed funds number but furthermore the interest rates and you will all you have to be considered. Interest levels and you will qualification requirements alter with assorted version of services. Such as, to find a single-house instead of a residential property such a buy-to-let mortgage is sold with individuals legislation.

Lenders pick certain characteristics because the higher risk, which could suggest they are going to lend less overall or request high interest rates than the other people. Thus, going for ranging from located in Southfields otherwise eyeing that best 2nd domestic you certainly will dictate your own home loan terms and conditions notably.

In the united kingdom, brief mortgages begin at the ?10,000. It number is exactly what some loan providers lay as his or her lowest having a mortgage otherwise remortgage. But not, of several banking institutions and mortgage team have a tendency to require a minimum mortgage loan level of ?50,000.

This type of numbers may vary based on the lender's rules and the borrower's monetary fitness. To possess properties, lenders could possibly get require the absolute minimum home mortgage value normally to ?forty,000 to adopt granting financing.

Enhancing your deposit and you may maintaining a remarkable credit rating enjoy big positions in being qualified of these small mortgage loans. Also essential was your income peak and outgoing expenses and that dictate how much cash banks are able to provide you for buying an excellent family or refinancing your dwelling place.

Techniques for Securing the tiniest You can easily Home loan

Finding the smallest financial begins with wisdom your bank account and you will just what lenders look for. We should inform you you're a secure choice by having a beneficial strong credit score and you may a reliable earnings.

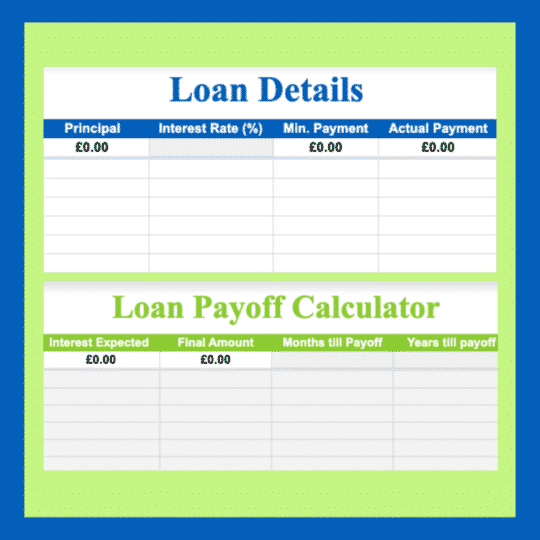

Believed takes on a big part, too; explore systems like online calculators to figure out how much cash house you can afford instead stretching your financial allowance also narrow.

Talking-to a home loan advisor may guide you courtesy different financial loans, be it repaired-rates home loans otherwise regulators-supported funds preparations like those on the Federal Casing Government.

They may be able let put a means to cure borrowing from the bank will set you back, particularly opting for shorter mortgage symptoms otherwise and make larger down payments. Basically, ensure you get your monetary ducks consecutively and you can look for professional advice to help you belongings the tiniest financial which works for you.

Take into account All potential Will cost you and you will Fees

Planning all the rates and you may fee is crucial if you are targeting the littlest home loan you'll be able to. It means just looking at the cost of your domestic, as well as factoring into the more expenditures such as for example settings charges, assets checks, lawyer's expenses, and you can Stamp Obligations.

Understanding all of your current can cost you helps you comprehend the complete image of just what it is possible to are obligated to pay. To own mortgage loans, this may involve not just your own monthly mortgage payments plus closure costs and you may rates of interest that affect simply how much you pay back over time.

Selecting the Optimal Home loan Package

Choosing the best mortgage package concerns researching different kinds of household finance, interest levels, and you will bank requirements. See repaired-price mortgages having steady monthly premiums historically.

Thought variable-rates options for those who assume your revenue to boost or if perhaps you want to go in the future. For each alternatives has its own positives and negatives, dependent on your financial situation and much time-title property preparations.

Talking to a large financial company can also direct you from the means of picking the ideal loan alternative. He's got access to various lenders and will offer recommendations based on your credit report, debt-to-income proportion, and you may down payment size.