Did you know each time you grab a different lender financing to suit your possessions, you will need to use the services of an excellent Conveyancing Legislation Agency?

Sure, whether you are making a unique domestic buy or refinancing your existing mortgage, lawyers away from an excellent conveyancing firm are involved.

- the financial institution you took the loan away from,

- the brand new CPF Panel,

- SLA,

- HDB, and you can

- IRAS.

The job of your conveyancing firm should be to make certain that all of the different payments are formulated on time towards relevant bodies businesses. Now that you understand what they do, you will most certainly agree that these types of attorneys try dealing with very important portion of their home loan application!

Yet, work out of a good conveyancing attorney mostly goes unnoticed inside the newest excitement of getting your brand new home. That's, until they screw up!

As mortgage brokers, we read of several nightmare tales away from improperly work on, most disorganised agencies that don't have the requisite tips during the spot to work on the part of your, the latest resident. Consequently, they cause clients to discover later charge on gahmen, late disbursement of financial mortgage and you will CPF funds or, in the terrible situation scenario, completely drop-off including good cowardly boyfriend scared of commitment! We are really not exaggerating - inquire someone on home loan world and they'll tell you the same story.

And if you are delivering home financing otherwise you're planning to refinance the loan the 5-10 years, they are things that you should take note of while in the your ending up in a conveyancing law firm.

The thing is, you can not also certain that your attorneys is there to help otherwise harm your. Very usually establish extent they are going to charge a fee before signing one agreements.

Such as for example, a strong could possibly get initial draw in you that have an extremely reduced legal payment. Ensure that the pricing is indicated NETT All-in, or something like that to this impression. For the reason that law offices range from a lot more charge also:

- Home loan Stamping payment

- CPF payment

- Rules Community fee

- GST

dos. Ensure that the the very first thing you earn in the conveyancing manager was a published schedule.

Your conveyancing attorneys can be more knowledgeable than your within this amount. One method to see is to see if they supply you which have a listing of times and due dates with respect to your property loan purchase or refinancing.

One conveyancing representative value their salt will get many of these authored, showcased and you may pointed out to you. Failure to meet such dates will result in penalties and fees and a lot more penalties and fees, so be sure to get a duplicate for your own personal site before you leave.

step three. Activation of CPF

Your conveyancing payment is sold with the fresh activation from CPF to have lump sum fee (also known as their down payment) as well as have activation away Vincent pay day loans no bank accoun from CPF to be used given that monthly cost. What the law states company has to pay a quantity in order to CPF to interact these types of for you.

As stated for the part step one it is already found in their percentage energized to you personally. Some businesses even if do not through the commission to have initiating the fresh month-to-month installment. Especially for Personal BUC characteristics. They then rescue one or two hundred dollars and that which have 50-100 website subscribers thirty day period change in order to grand money in their eyes thus ensure it is triggered!

4. Financial panel out of lawyers

Check if what the law states firm try under the committee of your own financial you desire to get financial financed less than to not incur additional expense. To have finance which are over $3 million, rates might be large. Create remember that attorneys will get change the cost and you can terminology anytime.

5. Personalised services away from start to finish

Having been about home loan world for over ten years, we realize there are various a beneficial law offices. Exactly how do you pick the best one to to suit your conveyancing need? Within our opinion, choose a strong that is going to be present to you when one thing get wrong.

Actually at best conveyancing law firms, errors do happens. The greater agencies handle more than eight hundred instances thirty days, there will always be the possibility of problems, unfortuitously. In the event the error 's the fault of your firm, just how many law firms make the effort to-do specific mode regarding recuperation? We've satisfied clients that reported in order to all of us precisely how terrible enterprises shirk their obligation and kept them in a state off stress.

I securely believe that a beneficial firm would-be obvious and upfront about what went completely wrong, and exactly how they will fix the new mistake. In case the mistake is enough time by the business, they get obligation for it and you will bear the costs. In case the mistake stems from the customer, they be here to spell it out and aid in new recovery process, but of course the consumer should be guilty of brand new mistake.

Conveyancing Law firm Charge within the 2023

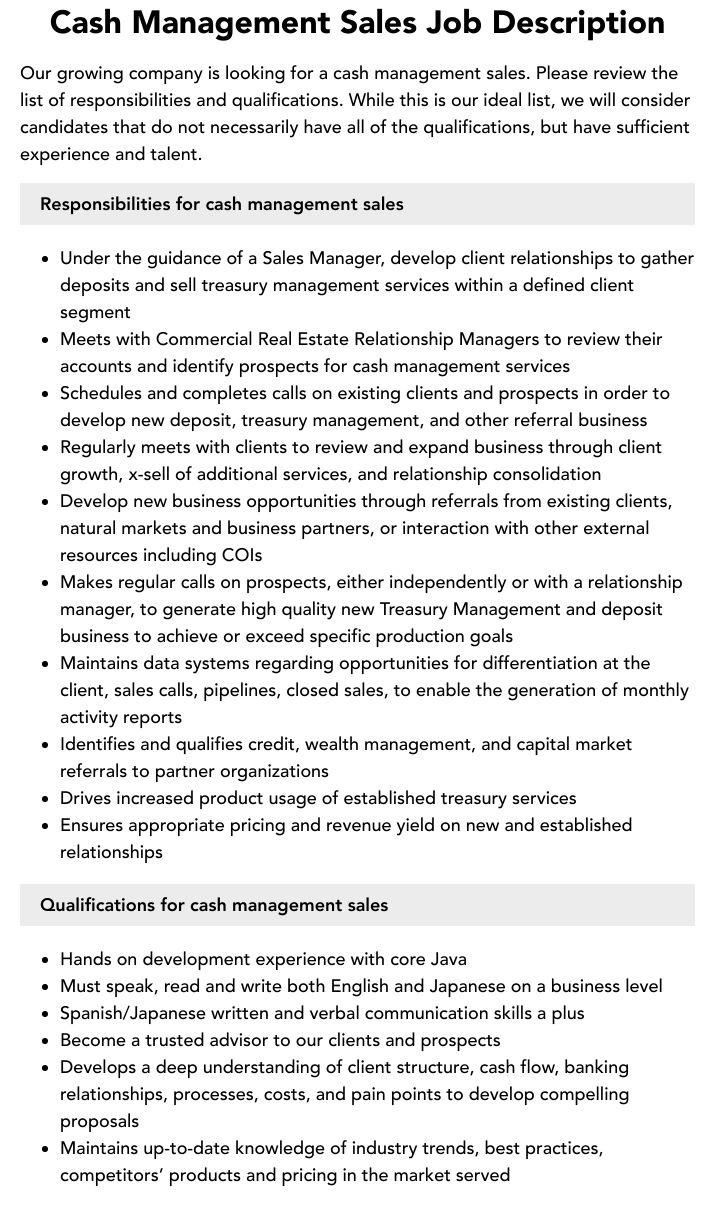

Is a list of regular conveyancing fees we provide out of a good lawyer. Such three organizations already been recommended because of their attention to outline and higher level out of responsibility so you're able to readers:

(Note: All of the costs are right since publishing time and you will reference standard times less than $2 million. Costs are NETT, including financial stamp duty, lookup and you will subscription payment and GST.)

Use up that loan by way of all of us and we'll in addition to highly recommend an informed conveyancing law offices inside Singapore and you will continue a good preferential rate. Contact all of our lenders from the Mortgage Grasp by the filling all of our enquiry means.